When you’re charting unknown territory, having a GPS to guide your journey is essential. It tells you where you are, where you’ve come from, and gives you a bird’s eye view of where you’re going. In bookkeeping, you get that same perspective from a Chart of Accounts (COA).

What Exactly is a Chart of Accounts?

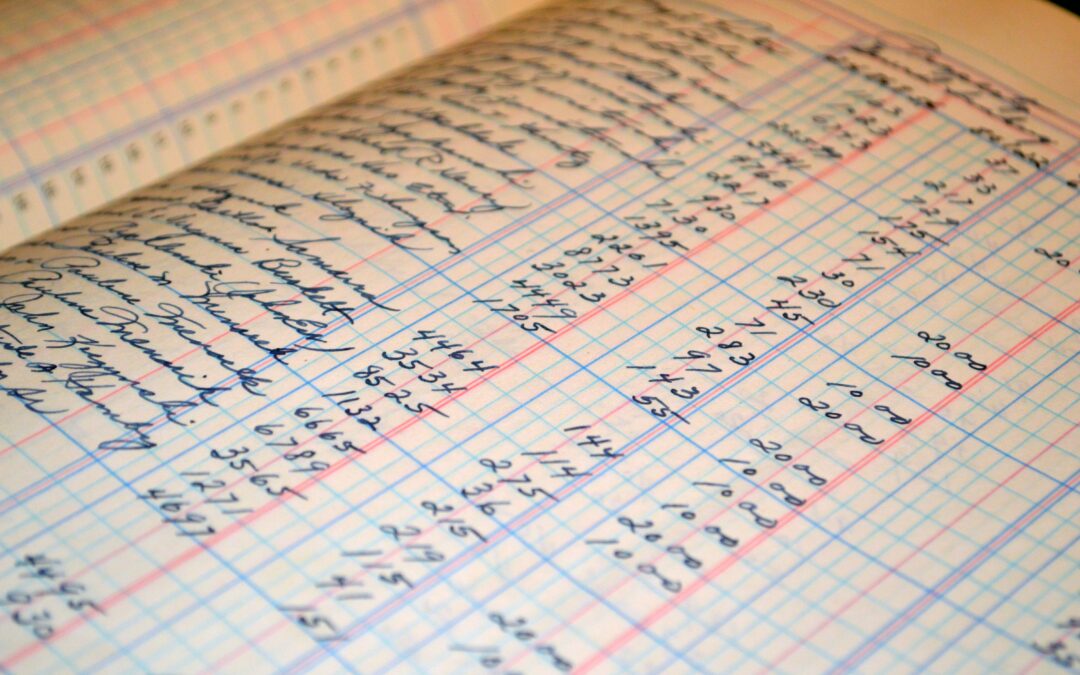

Think of the Chart of Accounts like a phonebook (those don’t exist anymore though, right?). The accounts are listed like names and businesses inside the phonebook, categorized and sorted to find what you need. And the phonebook itself is like your General Ledger.

Back in the bookkeeping world, a Chart of Accounts is an index of the financial accounts in your company’s general ledger (GL). The GL is a master accounting document that offers a complete record of all your company’s accounts, and the COA summaries that in brief. As a key financial tool, the Chart of Accounts should be used to plot your course, organize your finances, and share insights on your company with investors or shareholders.

Accounts are grouped into categories, and will include both balance sheet accounts (assets, liability, and equity) as well as income statement accounts (revenue, and expenses). Typically, balance sheet accounts are listed first. Each entry in the chart of accounts includes a name, brief description, and identification code. This makes it easy for anyone to locate a specific account.

Being familiar with your COA structure will allow you to truly understand the business

Evolve Your COA to Match Where You Are Today

Your COA shouldn’t be a static index of accounts. As your business evolves, so to should your COA. If your COA includes accounts that no longer need to be tracked at a high level of detail, consolidate them. If adding more accounts could be useful to understand the business, add them in.

3 Steps to a Strong COA

There are three main steps to a strong COA:

1. Measure Twice, Cut Once

First, ensure you have the correct accounts and that they are enabling you to track your business at the right level of detail. You want your COA to provide a complete picture of the business’s financial situation month by month. If something that could help paint that picture is missing, add it in. Although you should wait till the end of the year to remove an account from your COA, a new account can be added in at any time.

2. Check the Flow!

Second, verify that all transactions are flowing in as intended. Your COA will only be useful if it’s updated regularly, and missing information can leave you with inaccurate views of your financial position. This is usually a quick fix when you’ve located the problem.

3. Stay On Track

Finally, track variances between expected monthly balances and your actual balances. Find out why there’s a difference and, if you’re not where you hoped you would be, what you can do to change your trajectory before next month.

Let’s Chart Your Accounts Together

Setting up a proper COA, based on your business needs and goals, is one of the first things we do with all BASECAMP bookkeeping clients. Schedule a short intro call with us and we can help identify the right steps you need to take now in your bookkeeping process to ensure a successful journey ahead.

Next up: Staying Profitable While Selling Into Retail